Never let corporate people teach your kids money management

As I was doing my weekend reading, I saw this ad.

TUNEMONEY.COM promote their visa prepaid card with this line:

GIVE YOUR CHILD A HEADSTART ON MONEY MANAGEMENT.

What?? How is that? Children should never be taught to spend before they learn to earn.

This ad is absolutely wrong.

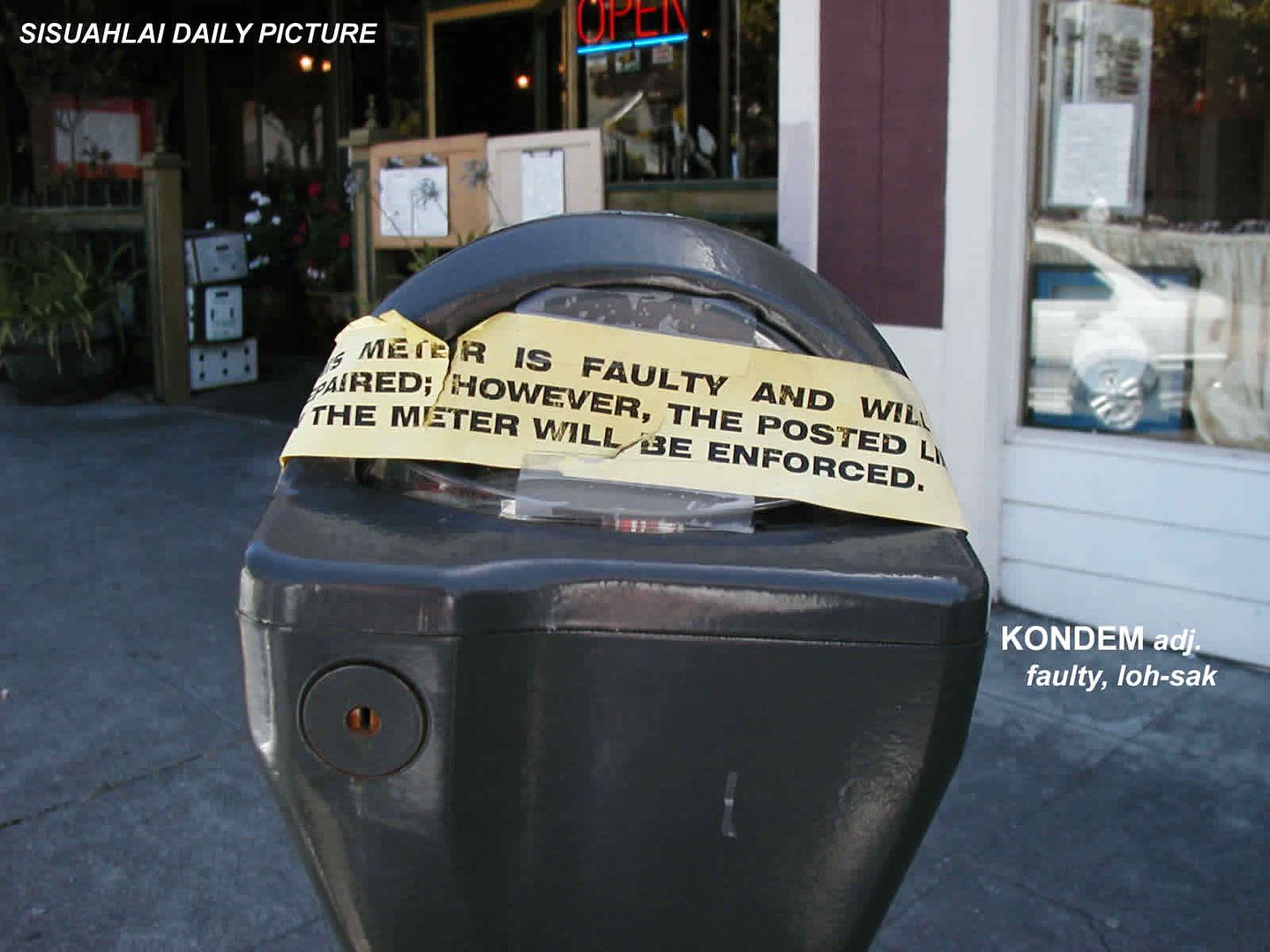

The "buying by card" culture has condemned many to a lifetime of debt. Although this particular card will not lead to spiralling interest payment as credit is paid upfront, it will still encourage loose spending habit. Personally, it is better to give the child 10 ringgit or 50 ringgit note than to load the card with several hundred of easy ringgit each time.

TUNEMONEY.COM promote their visa prepaid card with this line:

GIVE YOUR CHILD A HEADSTART ON MONEY MANAGEMENT.

What?? How is that? Children should never be taught to spend before they learn to earn.

This ad is absolutely wrong.

The "buying by card" culture has condemned many to a lifetime of debt. Although this particular card will not lead to spiralling interest payment as credit is paid upfront, it will still encourage loose spending habit. Personally, it is better to give the child 10 ringgit or 50 ringgit note than to load the card with several hundred of easy ringgit each time.

Isn't that a better money management for a child?

Labels: advertisement, corporate, debt, money, tunemoney

Your Chance to be (in)Famous!

If you want your photo (or any picture) to feature on Sisuahlai, please send it to

Your Chance to be (in)Famous!

If you want your photo (or any picture) to feature on Sisuahlai, please send it to

7 Comments:

hi,

it's main target is for children 15-17 who study in boarding school, for their safety also since carry less cash

That is the idea, but the consequence is going to be rather different.

For school boarders, I would imagine that there is even little need to have credit cards. I have yet to see widespread use of credit card reader in college food canteens. Bank ATM card should suffice.

I do not doubt the convenience afforded when one does not need to carry large amount of cash around. But why would a young child need to carry large amount of cash to begin with? Ok let's say college boarders, ATM machines are always within reach.If you live in a place or campus without ATM machines, then you should really see your school/college management. You should be very suspicious if people carry card swipers in around campuses.

Bank ATM card serves the same purpose as paid-up "credit" card, the fact that one has to physically go to a bank to get money will deter many impulse buys.

But Lankapo, I see your point but there are better alternatives I'm sure. (BTW, you don't work for Tunemoney do you? just saw a couple of your blogs on tunemoney.)

I remembered back when I was 12 in Singapore..they have a debit system called NETS, so it's a NETS-VISA card...so kids can go to shop for groceries..

it's a way to control own pocket money. Have it's ups and downs. Otherwise, with now being counterfeit currency so rampant, plastic is the way to do things.

Hi, I'm Jennifer from Tune Money and we would like to respond to your post.

While I appreciate your concern - I don't understand it. Why is it "wrong" for kids to have their money put in cards? Why do you consider those who are 15-17 too "young" to learn how to manage their money?

With the Tune Card, you get to see where your money is spent - with our online statements. Knowing where your money goes is the first step towards creating a budget. Wouldn't you agree that you're never too young to start budgeting your income?

And what about online transactions? Teenagers tend to shop online (let's face it, that's where the better deals are) and at the moment, they are forced to use their parents' credit cards. This gives them their own means of shopping online.

Finally I am truly puzzled as to how spending only money you have pre-loaded will encourage you getting into debt. What's the difference between giving a kid cash and loading that cash onto a card?

Lankapo: Can I just say, you're getting a bit of a fan base at Tune Money?

Geek: Right on, dude!

Jenn from TuneMoney.com,

The issue here is really with the ad line: Tunemoney.com... "Giving your child a headstart in money management."

You must be kidding. No, this is not the way to start teaching kids money management.

I suppose it wouldn't be that contentious if you say...

"A more modern and convenient way to help kids spend, and parents, you don't have to worry (that much) as the spending limit is fixed."

Then again this is far less sexy, but sadly, more accurate.

Ok, here is a neutral view on the matter... from Laura Levine, Executive Director of the JumpStart Coalition for Personal Financial Literacy.

"Parents who get pre-paid cards or debit cards for their kids, as well as parents who co-sign a credit card for them, need to remember a few things: If your son or daughter is under 18, then you, the parent, are responsible for that card, not your teenager. A debit or pre-paid card is not perfect "training" for a credit card; they are good money management tools, but don't teach your child about interest rates, making payments, accruing debt, etc.--and these are the things that new credit card users seem to struggle with. A teenager isn't going to learn--or isn't necessarily going to learn the right things--simply by getting and using a credit card. I often use the analogy of a musical instrument. We don't buy our kids violins and hope they'll just plunk around until they learn how to play it. Why would we think kids will learn how to manage money simply by being given a credit card?"

Here the author cited "good money management tool" but not necessarily fostering "good money management skills".

Post a Comment

<< Home